Over the next several years, governments in advanced countries will likely continue to struggle with mounting debt burdens and the associated rising costs of servicing that debt. It is also noteworthy to remember that total government debt continues to increase every year because of deficit spending.

So how does the Law of Large Numbers apply here? Simply put, at some point the whole debt situation could defy the ability of a government to control a national economy and the response to ever increasing debt burden costs. Here is a definition from Investopedia:

"In a financial context, the law of large numbers indicates that a large entity that is growing rapidly cannot maintain that growth pace forever." *

For example, the recent May 2019 U.S. Government deficit for spending came in at $208 Billion which is approximately a 41% year-over-year increase from May 2018 as noted by the Wall Street Journal.** Or to put it another way, U.S. Government spending inflated at a 41% rate in the previous twelve month period. This is clearly not a sustainable development.

To put this in some context, the U.S. is currently running annual budget deficits (in a generally better economy) that are close to twice the level that were existent in 2008-09.

If deficit spending and debt service costs (as well as debt levels) continue to rise at increasing rates, prudent investors (and Canadians in general) will likely face some type of eventual impact on their personal net worth and retirement savings. At some point, governments will very likely find themselves is a heated struggle to keep the system intact.

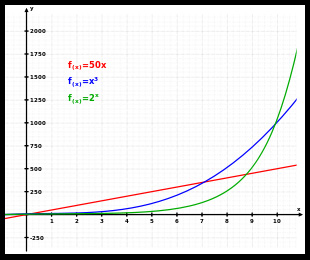

Some commentators are suggesting that, unless corrective actions are made soon, the level of U.S. government debt (Canada is no exception) is threatening to spin out of control and enter a period of exponential growth – a curve that looks like a “J” or a rocket ship. The green line represents exponential growth while the red line is linear growth. ***

While the exact timing of a move to exponential debt growth is quite impossible to predict, it is becoming more inevitable that such an event could occur sometime within the next 10 – 20 years - unless governments in developed nations alter course and adopt more fiscally prudent spending plans.

From historical precedents, if this economic crisis arrives soon it will likely be a once-in-a-100-year event that would impact the long-term financial strategies of Canadians for many years.

For investors looking to minimize how negative economic events might impact their retirement savings plans, a good asset allocation strategy is always the best starting point. Depending on an investor’s personal situation and risk tolerance preferences, it might also be wise to limit the purchase of new investments using borrowed money. Maintaining a high debt level during a time of economic contraction can often lead to balance sheet problems and missing out on new investment opportunities.

With every financial challenge, there are always steps that can be taken to protect assets and even thrive in difficult years - if you are prepared to act.

Call us today for a review of your financial situation to ensure that you are fully prepared for today’s economic risks and future new opportunities!

* https://www.investopedia.com/terms/l/lawoflargenumbers.asp

*** https://en.wikipedia.org/wiki/Exponential_growth

Copyright © 2019 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.