The recent market turmoil triggered by the COVID-19 virus (and its possible impact on economic activity) brings to mind some observations by legendary investor Warren Buffett. During his years of investing, he has famously stated that in the short-run (days, weeks, and months) the investment markets are a voting machine. People buy and sell investments based on price momentum, or their emotions regarding how comfortable they are with the price direction over a few days or weeks. Thus, they vote based on their opinions and feelings about the value of a specific investment.

However, Warren believes that, in the long term, the investment markets are counting machines – where your wealth builds over time based on steady and growing corporate profits.* He believes there is far less risk in this patient approach compared to the voting method that the masses of retail investors regularly use.**

As we have seen in recent weeks, the investing methodology used by individual investors becomes crystal clear during periods of market turbulence. The price methodology investor generally gets nervous and bails out quickly at the first signs of market weakness - since price is the only way they determine the quality of an investment.

The savvy investor, who buys quality companies and ignores short-term market price action, stays focused on long-term wealth building opportunities.

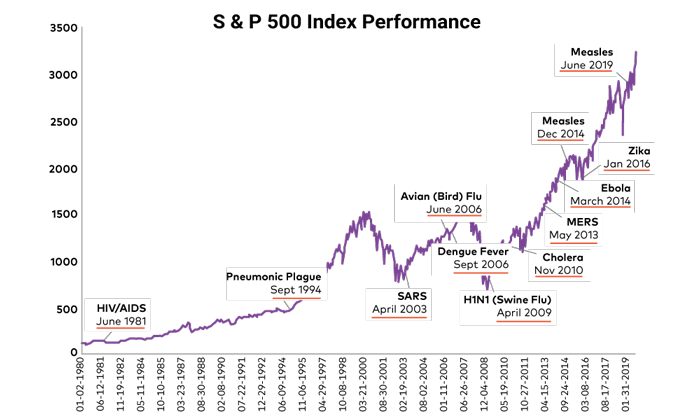

In considering the concept of "wealth building opportunities", the chart below illustrates how the S&P 500 index*** has behaved during the past 40 years of health calamities and other viral outbreaks similar to the COVID-19 outbreak that has spread around the globe.

Today, with computer-based automated trading systems (High Frequency Trading) and other technical-based market strategies that are based upon short term price movement, market corrections can happen much faster than ever before.

A normal market correction (10% decrease or more), which once may have taken several weeks to play out, is now often completed in just a few days. Therefore, the downdrafts are quick, short and sudden but not necessarily unexpected. Once a correction starts, computer-programmed selling usually kicks in adding to the depth and speed of any downside correction. Throw into the mix margin calls and you have a perfect storm for sharp and sudden market corrections.

The best investment strategy, is to have a portfolio positioned in advance for any unexpected bumps in the road. Given the speed at which markets can move today, having a plan that anticipates unexpected events, is prudent.

As a reminder, a margin call is where an investor uses the value of their investment portfolio to borrow money for other uses, such as buying real estate, etc. This is in effect a leverage strategy - not recommended - that uses an investment portfolio as collateral for other spending. Over the past several years, portfolio leverage once again rose to record highs, particularly in the larger markets such as New York City.****

The big problem with portfolio leverage is that a market correction can trigger a situation where an investor must add cash to their portfolio to make up for the fall in value of the underlying portfolio. When an investor is unable to do so (in a relatively short time frame), the investment brokerage sells some investments to correct the loan-to-asset-value ratios to keep the loan in good standing.

Finally, a reminder that the purpose of the investment markets is to provide liquidity for investors when they need cash for lifestyle spending purposes. The investment markets are auction markets and sometimes auction markets become detached (in the short term) from the underlying value of the actual investments.

The only price that really matters is on the day when a sale is necessary to fund lifestyle expenses - and that day may be many years in the future. Thus a short-term focus on price alone often pushes investors out of their investments too early. This leads to the forfeiting of potential future profit growth from the quality companies found inside a diversified investment portfolio or investment vehicle.

Patience will be rewarded. Call us today to review your asset allocation strategy and see how it fits into your longer term wealth building strategy.

*https://quoteinvestigator.com/2020/01/09/market/.

**http://www.butler-bowdon.com/warren-buffett---the-essays-of-warren-buffett.html/.

***Source: Bloomberg. *12-month data is not available for June 2019 measles.

****https://www.investmentexecutive.com/news/research-and-markets/leveraged-lending-surges-in-canada/.

Copyright © 2020 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.